Top 10 beach destinations for wealthy investors

Cancun and Daytona may draw spring breakers and Waikiki, honeymooners, but which beaches worldwide are millionaire magnets?

Hong Kong-based consulting company Nomad Capitalist released its latest annual index of the highest sandy spots that appeal to high-net-worth investors looking to not necessarily vacation but actually put down roots — and a few cash — within the world’s sunniest climes: the Nomad Beach Index for 2021.

The firm’s first such effort in two years — it took a Covid-related hiatus in 2020 — the index for this year features a top 10 ranking that has 24 beach destinations round the globe.

More from Personal Finance:Here’s why you almost certainly got to insure your next vacationNew apps match travelers with trips that fit budget, points balances Vaccine passports gain traction among travelers as delta variant surges

The firm graded beach destinations best fitted to entrepreneurs, investors, stockbrokers and other high-net-worth individuals looking to take a position , relocate and/or gain residency or citizenship. It aggregated data from quite 30 sources, ranking each on a scale from 1 to 50 to for beauty (30% of index ranking); services, taxes and immigration (20% each); and safety (10%). Thirty-six beaches were ranked in total.

The Cayman Islands tops this year’s list, thank to its status as a Caribbean country for investors who don’t wish to affect the complicated tax laws of other countries, consistent with Nomad Capitalist.

The company helps “seven- and eight-figure entrepreneurs [and] investors who want to possess a second home [or] have an idea B citizenship or residence, or all the above, [or] reduce taxes in some cases, although there’s less of that this year,” said founder Andrew Henderson. “With the pandemic, people are eager just to possess a second place where they will go.”

The NBI aggregates data from 30-plus sources to assign destinations scores for beauty, which counts towards 30% of a ranking; services, taxes and immigration (20% each); and safety (10%). Here are the highest 24 spots for 2021, ranked from 1 to 10 (including ties):

• Cayman Islands

• Antigua and Barbuda

• Bahamas; St. Kitts and Nevis (tie)

• Budva, Montenegro

• Algarve, Portugal; Vanuatu (tie)

• Crete, Greece; Mykonos, Greece; Cozumel, Mexico (tie)

• Langkawi, Malaysia; Santorini, Greece; Dominican Republic (tie)

• Dominica; St. Lucia; Mauritius; Ambergris Cay, Belize; Isla Colon, Panama (tie)

• Grenada

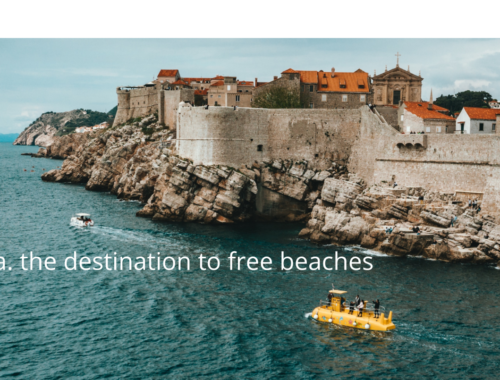

• Puerto Rico; Balearic Islands , Spain; Cebu, Philippines; Corn Islands, Nicaragua; Hvar, Croatia (tie)

Source: Nomad Capitalist

Other Caribbean nations like Antigua and Barbuda, St. Kitts and Nevis, Dominica and St. Lucia — along side the neighboring Bahamas —also made the highest 10. Proximity to the U.S. and a highly developed infrastructure and services sector factored in their rankings, consistent with Henderson.

“It’s also immigration [policy]; how easily are you able to get there?” he added. “You can attend Antigua [or] St. Kitts and acquire citizenship by investment in six or seven months.” (Actual timeframes vary by nation. St. Kitts and Nevis, for instance , features a reported average time interval of three months and as little as 45 days, consistent with the 2021 CBI Index.)

“Now you are a citizen and you’ll live there as long as you would like and luxuriate in the zero-tax policies,” Henderson. “I thought someone should take that under consideration along side which beach was the nicest.”

Investors residing abroad but retaining American citizenship, however, are still subject to U.S. taxes, so some — like Henderson — have turned in their blue passports to completely enjoy foreign tax regimes. But those that don’t wish to require that route can head for Puerto Rico, which came in at No. 10 along side spots in Croatia, the Philippines, Nicaragua and Spain.

“If you’re German or British, you’ll just leave the system, keep your passport and head down there,” he said. “For Americans, you are looking at Puerto Rico to stay your passport and still have great tax benefits.”

Indeed, Puerto Rico may be a convenient country for U.S. citizens. Qualifying residents of the island are exempt, for instance , from capital gains taxes.

Japan

You May Also Like

Best ranking beaches of the world

October 17, 2021

Tourism at the Maldives, Caribbean Islands, and policy of Safeguarding The Environment?

October 18, 2021